Do Australian Photographers Really Need Insurance?

Ideas, List & Types of Insurance Photographers Should Research

If you manage a photography business (or even if you’re a freelance photographer), you’ll most likely have to make a few business decisions in addition to creative ones. And just like in every other business, one of the most important decisions you’ll have to make will concern insurance.

Disclaimer: The information contained on this website & page is general in nature and should not be relied on as advice (personal or otherwise) because your personal needs, objectives and financial situation have not been considered. We are not licensed to give insurance advice so this is not it. The views expressed by others on this page are theirs.

Inherent risks involved in running a photography business

That’s because there are inherent risks involved in running a photography business for both your equipment and to other people and their property. And as a professional photographer, your creative output will be severely affected if you have to keep worrying about these risks every time you organize a shoot. In this case, insurance becomes less of an option and more of a necessity.

Do professional part-time, full-time & Freelance Photographers need insurance?

Simply put, all paid photographers should really consider insurance.

If you’re considering purchasing an insurance policy for your business, it’s important to find one that’s just right you.

This article is to assist you in identifying the type of insurance options available, but you should also keep in mind that we are not licensed insurance agents. To avoid doubt, it’s always best to check with a licensed insurance agent before settling on a policy and come to your own decisions.

But Why Do Photographers Need Insurance?

The first and most obvious reason you should consider taking out an insurance policy as a professional photographer is that accidents can and do happen, even in the most controlled of work environments.

Taking out equipment and liability insurance can keep you from going out of business in the event of unfortunate occurrences. Photography equipment costs lots of money, and if you’re willing to shell out those amounts, it’s only logical to invest in some protection for them.

What Type of Insurance Do Photographers Need?

- Public Liability

- Camera Equipment Cover

- Professional Indemnity

- General Property

- Business Interruption

Photographers should investigate these insurance products. We examine each of them individually below.

Who Provides Photographer Insurance in Australia?

Public Liability

Public liability insurance is also known as general liability insurance or simply liability insurance. This type of insurance cover, like every other type of cover, is optional. However, we strongly recommend public liability insurance for all types of businesses in all industries. Because, as the Australian government so aptly notes, the likelihood of getting sued is unpredictable and potentially very costly.

The Risk

As a photographer, you may need to transport your equipment or assistants to your clients’ premises for shoots or have your clients visit your studio. This is an essential part of the business, and for this, you should give serious thought to getting public liability insurance.

Public liability insurance can protect your business from significant damages that arise from personal injury to someone not employed by you and damage to someone else’s property.

To put this into perspective, getting ready for shoots involves setting up equipment quite often. This everyday act increases the risk of someone you didn’t employ slipping and sustaining potentially serious injuries.

The Benefit

In many western jurisdictions, you’re liable for any injury sustained under such circumstances, leaving you with an obligation to settle their treatment’s medical costs and legal defence costs if they decide to sue. For these types of scenarios, general liability coverage could shield you from third-party injury claims and medical expenditures.

In the same vein, you’ll also be liable to pay for damages to the equipment or personal belongings of your clients in those instances.

Suppose you have a suitable public liability insurance policy. In that case, the insurer may pay for the repair or replacement of the damaged property, settle the injured person’s medical expenses and cover you for the legal fees.

There are many good reasons why public liability insurance is vital for photography businesses.

Camera Equipment Cover

Next on the order of importance is insurance for your camera equipment. Camera equipment is a significant investment (they are hardly cheap), and as you know, operating a photography business would be next to impossible without them.

Many Freelancers and small studios may need cover for around $20 000 of equipment. Large studios could be closer to over $100 000.

Generally speaking, Camera equipment insurance helps cover loss or damage to cameras and other photography equipment such as lights, lenses, tripods, and memory drives.

For instance, if you accidentally drop the bag containing your equipment, such as your cameras and portable hard drive, damaging them in the process, a camera equipment policy could help cover the expenses. Some policies may even help with the costs of recovering lost data from the damaged drive along with the repair or replacement costs of the damaged camera.

The same outcome may apply for damaged equipment such as tripods and lights, even if the accident happens in your studio instead of out of it.

Read the fine print

Exclusions on insurance claims for damage, loss, or theft of your camera may vary depending on the policy you buy, so it’s a good idea to check the product disclosure statement of any product you’re contemplating or directly ask the insurer.

It’s crucial not to assume that your homeowner’s or renter’s insurance covers business equipment, as many policies exclude equipment used for profit. Always check.

Professional Indemnity

This type of insurance cover (also called Errors and Omissions Insurance) protects you and your business from claims from clients alleging a breach of contract or a failure to deliver upon agreed service terms. This type of suit is surprisingly common in the photography business, where quality is always defined in subjective terms.

Sometimes, it’s hard for photographers and their clients to find common ground on what constitutes quality. Clients may file this type of claim if they feel you’ve made a fundamental error in the delivery of your service, whether or not the error is intentional or not.

Are you covered?

Professional indemnity insurance covers losses suffered due to claims for professional negligence, errors, or omissions. It covers you if your client suffers a financial loss due to your advice, actions, or omissions.

Professional indemnity insurance can protect you from claims if your company provides professional services. The coverage may include protection from clients and other parties alleging that your professional advice, services, or designs caused them to suffer financial losses or other damages, as well as cover your legal fees and any compensation payments ordered by a court.

Always seek suitably qualified persons’ advice before relying on an introductory informational article such as this one.

Read More

Corporate Event Photographers Sydney – Conference, Meetings, Galas & Trade Shows

Orlando Sydney2024-04-08T16:31:43+10:00

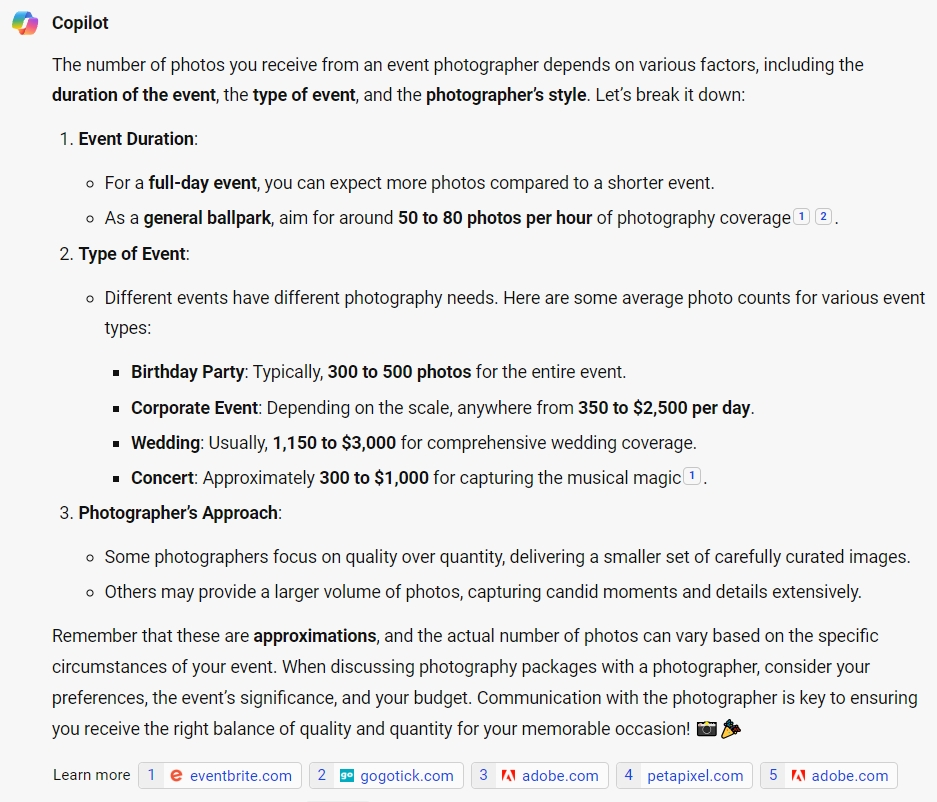

How Many Photos Do I Get for Event Photography?

Orlando Sydney2024-03-02T18:46:19+11:00

Your Executive Image: Photography for Leaders in Sydney

Orlando Sydney2024-03-22T19:10:13+11:00

Price List for Headshots – What’s it Cost – Package Rate Options

Orlando Sydney2024-03-08T10:53:02+11:00

Standard Photo Size Guide for Event Photography & Video

Orlando Sydney2024-01-16T11:33:01+11:00

Personal Branding Photography – Headshots for Entrepreneurs in Sydney

Orlando Sydney2024-01-11T14:32:31+11:00

General Property Insurance

General property insurance covers the loss of those properties separate from your primary work equipment, such as your camera, lighting, and other gear. But which are valuable enough to your photography business that loss or damage to them might negatively impact your business.

Gadgets such as your laptop or other computer equipment are vital enough to your photography business to warrant an insurance policy cover indemnifying you against their loss or potential damage.

For instance, you’ll probably need your laptop to edit photos and videos or create special effects. Your laptop may also be your database, where you save old photos from jobs, freeing up your camera’s memory space. NAS storage systems are also commonly used in small studios, these systems can be quick pricy, so some coverage is a good idea.

This type of insurance may also cover your car or other means of transport. For photographers who always need to be on the move, an easily accessible means of transportation can be just as important as their camera.

General property insurance may foot the repair or replacement costs of any of these properties in case of accidental damage or loss. Before taking out a policy for this type of insurance, you may need to carefully examine what the insurer defines as accidental damage and their replacement or repair policy.

Do Photographers need Business Interruption Insurance?

Like all other insurance it depends. For larger businesses it’s a discussion to have with your advisors for sure.

Some of the things that are sometimes covered are loss of income during periods when you cannot carry out business as usual due to an unexpected event. Business interruption insurance is for help in putting your business back in the same trading position it was in before the event occurred.

We have found a Business Insurance Broker to be of value in the past.

Australian Photographers Insurance Options

BizCover

Written by Polly Hancock (BizCover)

Polly Hancock is the Content Executive at BizCover, delivering insurance made easy for small business owners across Australia and New Zealand.

Working with numerous clients, visiting different spots for photoshoots and carrying expensive equipment is all in a day’s work as a photographer. If you operate in the photography industry, you may wish to consider insurance to help protect you and your business from risks and unexpected events.

Public Liability insurance is one of the most useful options for photographers. If you own or manage a business, you have a responsibility to ensure the safety of your staff and customers. This type of insurance is designed to assist you if a client or member of the public claims losses due to injury or property damage as a result of your alleged negligent business activities.

We are all human and are bound to make mistakes. No matter how careful you are, it is possible that someone may be injured, or something may be damaged during your photography sessions. Imagine if a client tripped over an item such as a light stand at a photoshoot. Could your business withstand the financial and reputation damage associated with a public liability claim? Let the insurers and lawyers handle it, while you stay focused on what you do best – running your photography business.

Photographers should also consider Portable Equipment insurance. This covers you for loss or damage of portable items associated with your business, such as your cameras and other photography equipment. What would you do if something happened to your gear? Could your business and back pocket survive? In the event of theft, a fire or storm, a car accident or other damage, make sure you are protected!

Here’s a real-life claims example. Whilst shooting a film, a crew found that native birds had attacked some of their photography gear! Luckily, the cost of replacing their drone and camera kit was covered as they had a Portable Equipment policy with BizCover.

GSK Insurance

Written by GSK Insurance (GSK Insurance Brokers)

GSK Photography Insurance, we provide photographers with tailored insurance solutions to ensure that your risks are protected. We understand the complex nature of your work and our experienced brokers will develop insurance cover which caters specifically to your needs.

We’re looking for an overview of your business together with some detail on your insurance products for professional photographers of any type.

GSK Insurance Brokers, established in 1981 are one of Australia’s leading providers of risk management, insurance, claims advocacy and workers’ compensation related advice. Our client proposition is built upon deep specialist knowledge, client’s best interest, tailored advice and service excellence.

Drawing on 40 years of experience in the Australian insurance marketplace, our clients are those that seek competitively priced, personal service with structured risk and insurance programs tailored specifically to meet their needs.

Our focus is to ensure that we continuously deliver risk mitigation solutions that provide our clients with confidence knowing their business and personal assets are well protected.

Battleface

Written by Battleface Insurance Services Ltd.

Protecting your photography equipment while traveling can be an important task on your travel safety itinerary; especially if you’re an avid photographer who loves their gear.

Sometimes we find ourselves in situations as photographers we cannot truly plan for: exploring the outdoors, traveling from destination to destination, and all the while we’re lugging our photography gear right by our side.

If something goes missing, becomes accidentally broken, or is stolen; you want protection. This is where a travel insurance policy from Battleface could come in handy. Learn more, right here at battleface.com

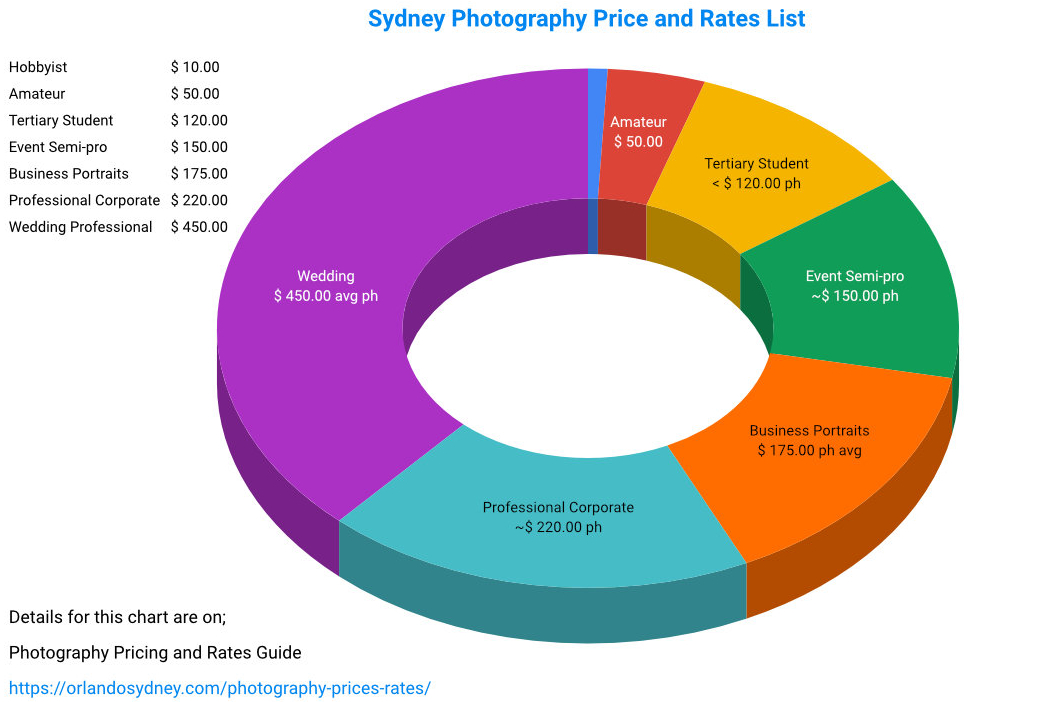

How Much Does Public Liability Insurance Costs For Photographers?

Public liability insurance for photographers

Costs for public liability insurance for photographers generally differ from insurance company to insurance company. However, the average cost varies from $400 to $800 per year.

This fee could be higher or lower depending on the number of employees (if any) or if you’ve had prior claims. A good way to reduce insurance costs is to include all your business insurance needs in one package. Even if you’re unsure about whether you need PL or PI insurance, ask for a quote and read the full disclosure statements to make an informed decision if it’s a good fit for you.

Do Photographers Carry Insurance?

In Australia, a few industries are required by law to carry insurance. Photography businesses are not included in this list, but it remains a smart move for photographers to protect their business interests by getting insurance. Insurance protects the photographer and their equipment from claims that could potentially cripple their business and jeopardize their source of livelihood.

Event Photographers, What Insurance should they consider?

Event photographers shooting in publicly accessible spaces should in our personal opinion, always have appropriate insurance coverage.

Most hire venues in your capital city in Australia ask for insurance certificates, if they don’t your hirers or event organiser most likely will.

Do photographers need Professional Indemnity?

If you give specific advice to clients, it is recommended to cover yourself with professional indemnity insurance.

Commercial Photographers, What Insurance Should they consider?

In general, you’ll need adequate insurance for your photography business for these three reasons:

Medical Costs

Companies are liable for any injuries their workers sustain while executing the company’s interests within its premises. The same is also true for photography businesses, to an extent. You will be liable if you or your equipment cause an accident during a photo shoot, and you’ll have to foot the medical bills of the injured party.

Now, depending on the severity of the injury, the bills may be substantial, putting a severe strain on you and your business. However, if your business is insured, your insurer will easily cover these costs. Always read the insurer PDS for what you’re covered for what you’re not.

Equipment Damage and Loss

Loss or damage of equipment will deal a near-fatal blow to most photography businesses. Photography gear does not come cheap, and starting all over again is a daunting proposition that not everyone is courageous enough to try. Photography businesses that are indemnified against damage or loss of equipment will find it infinitely easier to survive either of these occurrences.

Lawsuits

As you may well know, photographers are not immune from the occasional lawsuit from clients, friends, and even family members. Disgruntled clients may decide to file a suit against you for any perceived breach of contract, even if you are not directly liable and the blame did not come from an oversight on your part.

Photographers and their businesses get sued for other reasons as well, and even if you end up victorious, you’ll still have run up substantial legal costs. Indemnity insurance can help offset these costs and help keep your business afloat.

Other Insurance Cover For Photographers To Consider or Add to their existing policies

We will briefly touch on a few other insurance covers that photography business owners should seriously consider getting. Some of them are:

Life Insurance

Life insurance is the big one, yet it gets overlooked a lot. In a way, that’s understandable because most people find it challenging to come to terms with their mortality. Yet, it’s best to be prepared for any eventuality.

Life insurance helps provide small business owners with peace of mind, along with the guarantee that their family members are covered in the event of their death. Essentially, life insurance can also help offset debts that arise from the folding of the business.

Disability Insurance

Disability insurance protects the photography business owner’s income against the risk of disability that stops them from working as well as they could or should. There are insurance policies covering both short-term and long-term disability.

Business Interruption Insurance

Also known as Business Continuity Insurance, Business Interruption Insurance is designed to provide funding to a business that allows it to continue trading when its usual source of income, usually sales, is unavailable due to a specific occurrence. Businesses can benefit from essential risk protection from Business Interruption Insurance because income is not generated without an operational business, but costs such as rent and employees are still incurred.

Electronic Data Loss Insurance

Computers and other mechanical devices can be unreliable at times, and they can malfunction in the most inopportune moment, leading to loss of essential data and records. That’s why electronic data loss insurance is important. This type of policy protects your business against loss of data due to computer and other equipment malfunctions.

Final Words

Protecting your assets from liability claims and against potential loss and damages is a smart move that you should invest a lot of thought into as a photography business owner.

In addition to getting insurance cover for your business and equipment, you need to choose the right business structure. Insist on the use of proper legal documents for every business transaction. Establishing your business as a Limited Liability Company provides a clear distinction between your business and personal assets on the one hand, while the other may come in handy when clients threaten to sue for breaches.

Disclaimer: The information contained on this website & page is general in nature and should not be relied on as advice (personal or otherwise) because your personal needs, objectives and financial situation have not been considered. We are not licensed to give insurance advice so this is not it. The views expressed by others on this page are theirs.